The quotes below are from articles that have appeared recently discussing Trump, global trade, national security, the WTO, U.S. trade policy, U.S-China trade, and U.S. foreign policy generally — seen through the prism of recent events and the current U.S. presidential race.

To me, I find them particularly succinct. They highlight the broad and disturbing aspects of geopolitics and trade as we enter a new presidential election in the United States.

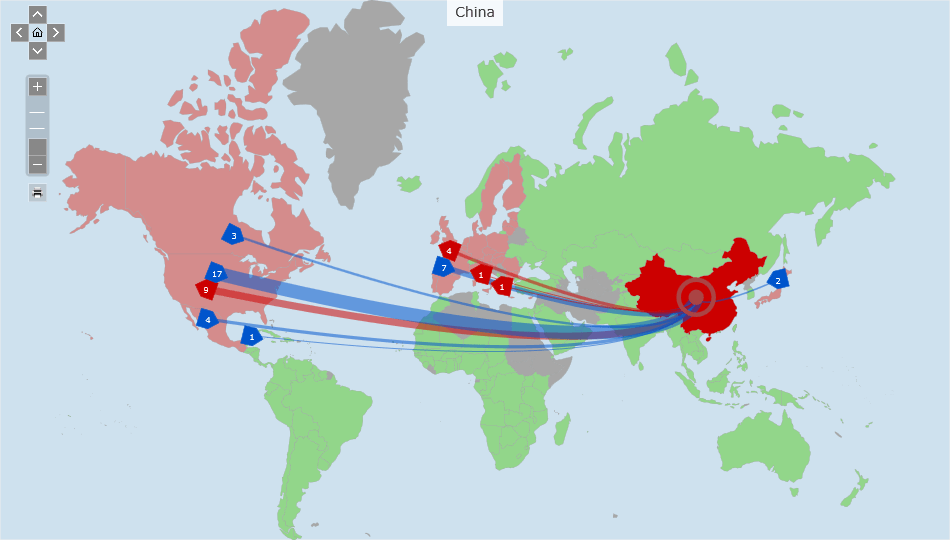

The way these issues will play out will have immense impact on U.S. corporations as well as the United States (domestically and internationally), the global trade and political systems and in particular U.S.-China trade relations.

-

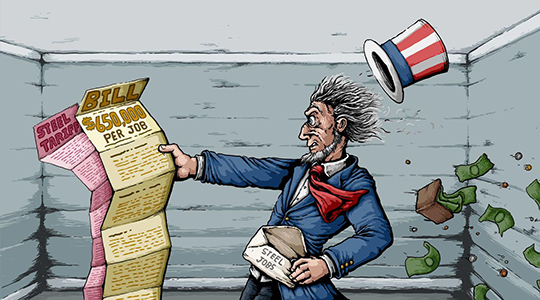

Biden’s sophisticated economic nationalism is a very big deal, much more so than Trump’s protectionist thrashing …. China just filed a complaint with the World Trade Organization about the Inflation Reduction Act, which, despite its name, is at its core an attempt to fight climate change …. China complained about electric vehicle subsidies that it says unfairly discriminate against production using car battery components made in China …. America’s new industrial policy does favor domestic production and — we’ll see — might be in violation of W.T.O. rules …. In 2022, the W.T.O. ruled that U.S. tariffs on steel and aluminum, imposed under Trump but retained under Biden, were illegitimate. The U.S. is also promoting semiconductor production … And the Biden administration has imposed stiff limits on technology exports to China, with the clear goal of crimping Chinese technological progress in advanced semiconductors and computing …. Biden’s China policy is so tough that it makes me, someone who generally favors a rules-based system. Krugman, “Bidenomics and China.” New York Times (March 29, 2025).

-

China filed a complaint at the World Trade Organization over the U.S.’s Inflation Reduction Act, saying that it was discriminatory and distorted fair competition. The rules being challenged require vehicles to use parts from specific regions to qualify for subsidies while excluding products from China. Under the Inflation Reduction Act, consumers in the U.S. won’t be able to claim a $7,500 clean-vehicle tax credit if they buy cars containing battery components from a “foreign entity of concern” starting in 2024. The policy will extend to the minerals that go into battery components in 2025. “China Files WTO Complaint Against US Over EV Subsidies.” Wall Street Journal (March 27, 2024).

-

“After a long dormant period since the Washington Consensus of the 1980s, industrial policy is back and dramatically reshaping global manufacturing. As large-scale subsidies policies proliferate, countries that used to take a laissez-faire approach to market governance have entered a race to subsidize strategic sectors …. In response to China subsidies, President Biden’s Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIPS) amplified and implemented subsidies so attractive …. likened them to a gold rush.” “Trade Distortion and Protectionism — Fighting Subsidies with Subsidies.” Hinrich Foundation (March 26, 2024).

-

“The latest purchasing rules represent China’s most significant step yet to build up domestic substitutes for foreign technology and echo moves in the US …… Washington has imposed sanctions on a growing number of Chinese companies on national security grounds, legislated to encourage more tech to be produced in the US and blocked exports of advanced chips.” “Beijing Block Chips.” Financial Times (March 24, 2024).

-

“(US trade policy has become) rank protectionism. For instance, US national security adviser Jake Sullivan’s evocative picture of shielding a “narrow yard” of security-relevant technologies with “high fences” has expanded quickly into a much broader yard where any device or platform that collects information can be banned on security grounds, whether it be Chinese EVs or TikTok in the US or Apple and Tesla in China.” “Protectionism.” Financial Times (Marc 22, 2024).

-

“(The question is) if Washington’s bipartisan turn away (Nippon Steel case) from economic liberalism, in favor of state-directed investment strategies and trade protectionism, will ultimately help the economy.” “Bidennomics and the Nippon Steel – US Steel Dive.” Wall Street Journal (March 22, 2024).

-

“The U.S. may be slouching toward state capitalism (like China) in which government regularly intervenes in business to ensure it serves the national interest.” “U.S. and China-Style Capitalism.“ Wall Street Journal (March 21, 2024).

-

“The trend increasing state power (recent Supreme Court immigration case) will have far-reaching consequences not only for domestic politics but also for U.S. foreign policy …. (T)his shift will determine whether state-level action becomes a source of resilience or a destabilizing force. “Fractured Superpower — Federalism and Foreign Policy.” Foreign Affairs (March 23, 2024).

-

-

“(The recent filing of a Section 301 case by labor in the U.S. International Trade Commission as to China’s subsidies to its ship building sector has) the potential to reignite the U.S.-China trade conflict, but it will also increase the focus on China’s military might and the massive commercial shipping industry that underpins it.” “Shipping as the New Battleground in the US-China Trade War.” Financial Times (March 13, 2024).

-

“Everyone knows the Trump-Biden election campaign is going to be nasty, brutish and not short enough, but the unknown is how much policy damage it will do. One unfolding example is the fiasco of self-destructive opposition to Nippon Steel’s proposed acquisition of U.S. Steel. The American political consensus used to be that foreign investment is a sign of U.S. economic strength and a source of good-paying jobs …. But now they’re targeting even investment in U.S. manufacturing from friendly countries.” “Nippon Steel Fiasco.” Wall Street Journal (March 15, 2024). “

-

(The new ‘Washington Consensus’) calls for a mix of tariffs and subsidies to support domestic industries … Freewheeling global trade helped lower consumer prices but at the expense of U.S. workers and national security.” “Retreating Further on Free Trade.” Wall Street Journal (March 17, 2024).

-

“The Biden administration has reasserted the role of the state in the US economy: subsidizing strategic industries, rethinking trade relations and rebooting competition policy.” “America and Industrial Policy.” Financial Times (Match 17, 2024).

-

“There is a pattern. The deep-seated US aversion to subjecting its domestic laws to international institutions or foreign courts is the same US exceptionalism that explains American hostility to the WTO’s judicial function. It also explains America’s refusal to join the International Criminal Court and other international bodies.” “When the US Fell out of Love with Geneva.” Hinrich Foundation (March 19, 2024).

-

“An American president opposing investment by a staunch ally (Nippon Steel) in a US manufacturing company (US Steel) is a sign that protectionism has run amok. What Biden should be focused on instead is the long-term prosperity of the American people. Nippon’s acquisition of US Steel would benefit the economy broadly and the working class specifically.” “Protectionism is Running Amok in the US.” Financial Times (March 18, 2024).

-

“The TixTox legislation sailed through the House … (A) court would require judges to weigh national security … The U.S. has long restricted foreign ownership in radio, television …. A federal court ruled against Commerce Dept. efforts to ban TikTok during the Trump administration (under the International Economics Powers Act) … Similar legislation unfolded when the Trump administration sought to ban WeChat.” “TixTox Ban and Free Speech.” Wall Street Journal (March 19, 2024).

-

“Huawei, China’s telecom and mobile-technology champion, is a poster child for the country’s high-tech ambitions—and a symbol of Washington’s determination to cut them down to size … It’s surprising resilience in the face of U.S. sanctions therefore says a lot about how the tech war is likely to unfold in the years ahead ….. But the further down the technological ladder sanctions extend, the more difficult they are to enforce—as the West has discovered with Russia since 2022.” “Huawei and Limits of U.S. Power.” Wall Street Journal (March 21, 2024).

-

-

“(The recent filing of a Section 301 case by labor in the U.S. International Trade Commission as to China’s subsidies to its ship building sector has) the potential to reignite the U.S.-China trade conflict, but it will also increase the focus on China’s military might and the massive commercial shipping industry that underpins it.” “Shipping as the New Battleground in the US-China Trade War.” Financial Times (March 13, 2024).

-

“Everyone knows the Trump-Biden election campaign is going to be nasty, brutish and not short enough, but the unknown is how much policy damage it will do. One unfolding example is the fiasco of self-destructive opposition to Nippon Steel’s proposed acquisition of U.S. Steel. The American political consensus used to be that foreign investment is a sign of U.S. economic strength and a source of good-paying jobs …. But now they’re targeting even investment in U.S. manufacturing from friendly countries.” “Nippon Steel Fiasco.” Wall Street Journal (March 15, 2024). “

-

(The new ‘Washington Consensus’) calls for a mix of tariffs and subsidies to support domestic industries … Freewheeling global trade helped lower consumer prices but at the expense of U.S. workers and national security.” “Retreating Further on Free Trade.” Wall Street Journal (March 17, 2024).

-

“The Biden administration has reasserted the role of the state in the US economy: subsidizing strategic industries, rethinking trade relations and rebooting competition policy.” “America and Industrial Policy.” Financial Times (Match 17, 2024).

-

“There is a pattern. The deep-seated US aversion to subjecting its domestic laws to international institutions or foreign courts is the same US exceptionalism that explains American hostility to the WTO’s judicial function. It also explains America’s refusal to join the International Criminal Court and other international bodies.” “When the US Fell out of Love with Geneva.” Hinrich Foundation (March 19, 2024).

-

“An American president opposing investment by a staunch ally (Nippon Steel) in a US manufacturing company (US Steel) is a sign that protectionism has run amok. What Biden should be focused on instead is the long-term prosperity of the American people. Nippon’s acquisition of US Steel would benefit the economy broadly and the working class specifically.” “Protectionism is Running Amok in the US.” Financial Times (March 18, 2024).

-

“The TixTox legislation sailed through the House … (A) court would require judges to weigh national security … The U.S. has long restricted foreign ownership in radio, television …. A federal court ruled against Commerce Dept. efforts to ban TikTok during the Trump administration (under the International Economics Powers Act) … Similar legislation unfolded when the Trump administration sought to ban WeChat.” “TixTox Ban and Free Speech.” Wall Street Journal (March 19, 2024).

-

“Huawei, China’s telecom and mobile-technology champion, is a poster child for the country’s high-tech ambitions—and a symbol of Washington’s determination to cut them down to size … It’s surprising resilience in the face of U.S. sanctions therefore says a lot about how the tech war is likely to unfold in the years ahead ….. But the further down the technological ladder sanctions extend, the more difficult they are to enforce—as the West has discovered with Russia since 2022.” “Huawei and Limits of U.S. Power.” Wall Street Journal (March 21, 2024).

-

“(O)ne going back to the 1980s has been his (Trump’s) conviction that the United States has been shafted by allies on trade, immigration and security.” “Disdain of U.S. Alliances.” New York Times (Feb. 16, 2024).

-

“(The recent filing of a Section 301 case by labor in the U.S. International Trade Commission as to China’s subsidies to its ship building sector has) the potential to reignite the U.S.-China trade conflict, but it will also increase the focus on China’s military might and the massive commercial shipping industry that underpins it.” “Shipping as the New Battleground in the US-China Trade War.” Financial Times (March 13, 2024).

-

“Everyone knows the Trump-Biden election campaign is going to be nasty, brutish and not short enough, but the unknown is how much policy damage it will do. One unfolding example is the fiasco of self-destructive opposition to Nippon Steel’s proposed acquisition of U.S. Steel. The American political consensus used to be that foreign investment is a sign of U.S. economic strength and a source of good-paying jobs …. But now they’re targeting even investment in U.S. manufacturing from friendly countries.” “Nippon Steel Fiasco.” Wall Street Journal (March 15, 2024). “

-

(The new ‘Washington Consensus’) calls for a mix of tariffs and subsidies to support domestic industries … Freewheeling global trade helped lower consumer prices but at the expense of U.S. workers and national security.” “Retreating Further on Free Trade.” Wall Street Journal (March 17, 2024).

-

“The Biden administration has reasserted the role of the state in the US economy: subsidizing strategic industries, rethinking trade relations and rebooting competition policy.” “America and Industrial Policy.” Financial Times (Match 17, 2024).

-

“There is a pattern. The deep-seated US aversion to subjecting its domestic laws to international institutions or foreign courts is the same US exceptionalism that explains American hostility to the WTO’s judicial function. It also explains America’s refusal to join the International Criminal Court and other international bodies.” “When the US Fell out of Love with Geneva.” Hinrich Foundation (March 19, 2024).

-

“An American president opposing investment by a staunch ally (Nippon Steel) in a US manufacturing company (US Steel) is a sign that protectionism has run amok. What Biden should be focused on instead is the long-term prosperity of the American people. Nippon’s acquisition of US Steel would benefit the economy broadly and the working class specifically.” “Protectionism is Running Amok in the US.” Financial Times (March 18, 2024).

-

“The TixTox legislation sailed through the House … (A) court would require judges to weigh national security … The U.S. has long restricted foreign ownership in radio, television …. A federal court ruled against Commerce Dept. efforts to ban TikTok during the Trump administration (under the International Economics Powers Act) … Similar legislation unfolded when the Trump administration sought to ban WeChat.” “TixTox Ban and Free Speech.” Wall Street Journal (March 19, 2024).

-

“Huawei, China’s telecom and mobile-technology champion, is a poster child for the country’s high-tech ambitions—and a symbol of Washington’s determination to cut them down to size … It’s surprising resilience in the face of U.S. sanctions therefore says a lot about how the tech war is likely to unfold in the years ahead ….. But the further down the technological ladder sanctions extend, the more difficult they are to enforce—as the West has discovered with Russia since 2022.” “Huawei and Limits of U.S. Power.” Wall Street Journal (March 21, 2024).

-

-

“A second Trump term would see American unilateralism on steroids.” “American Unilateralism,” Financial Times (Feb. 13, 2024).

-

“(A) second Trump administration will not only be fired by a desire for revenge and a radicalized Republican party. It will also inherit from Biden a state machinery schooled o a much darker view of the world than which Obama bequeathed to Trump.” “America’s Economic Security.” Financial Times (March 5, 2024).

-

“In this new environment, the success or failure of foreign policymaking increasingly depends on corporate decision-making.” “Geopolitics and Corporations.” Foreign Affairs” (March 11, 2024).

-

“(U)”nless Washington recovers its commitment to a rules-based trading system, the organization (WTO) it painstakingly helped build over half a century to police international commerce will prove irrelevant to the new global challenges.” “World Trade Organization.” Washington Post March 4, 2024).

-

“At the top of my worry list for a second term (for Trump): an even more aggressively protectionist approach to trade.” “Economic Impact and Trump 2.0.” New York Times (Feb. 29, 2024).

-

“The main headwind for the global trading system has come in the form of a breakdown of the WTO’s dispute resolution system. .” “China and World Trade.” Financial Times (Feb. 27, 2024).

-

“The world has shifted away from decades of emphasizing private competition and has plunged into a new era of competitive policy.” “Bidenomics” New York Times (Feb. 29, 2024).

You must be logged in to post a comment.