The following two items are from my previous book on Trump and Trade. It’s the Preface by Peter Watson the former Chairman of the U.S. International Trade Commission and my Introduction. I also include a recent blog of mine and an excellent review of Trump Trade 1.0. At this point, I leave it to the reader to decide if Trump’s proposals for trade in this reelection campaign are worse than his actual policies during his prior term. Clearly, his recent suggestion that 100% tariffs on various imports and for tariffs to replace income tax is not inspiring, to say the least.

………………………………………………………..

PREFACE The Honorable Peter S. Watson, LL.B., DCL — To Stuart Malawer, TRUMP AND TRADE — POLITICS AND LAW (HeinOnline) (2020).

“It is good news that Professor Stuart Malawer has selected and compiled the numerous articles that he has authored over the last four years of the Trump administration’s attack on the global trading system and his ferocious, unending attacks on the U.S. legal system and the rules-based international system and its institutions.

Professor Malawer and I share the experience of having earned both a law degree and a doctorate focusing on international law and trade. My professional experience includes serving on the National Security Council, as Chairman of the U.S. International Trade Commission, and as President of the Overseas Private Investment Corporation. Our professional and educational interests in global trade, international law, foreign policy, international investments, economic development, and national security overlap significantly.

Since the 1990s, I have collaborated with Dr. Malawer on a range of global activities. Most notably we have been colleagues at the Oxford Trade Program, a partnership between St. Peter’s College, Oxford, and George Mason University. As part of that program, we developed a week-long Geneva briefing: held at the World Trade Organization in Geneva, Switzerland. This was one of the first global trade programs for graduate, business, law, and trade students emphasizing the WTO, its dispute resolution system, and other international institutions.

I agree fully with Dr. Malawer’s conclusion: “Trump’s attacks on the existing international system have significantly diminished the standing of the United States in diplomatic relations with our friends and allies and has only emboldened others to take unilateral actions. Consequently, over the last four years, the United States has failed to formulate viable foreign policies and strategies to tackle the multitude of global problems confronting its national interests and security.”

If I were to summarize Professor Malawer’s contribution, it would be the following: he clearly understands inter-connected trade, law and public policy problems within an interdisciplinary construct. His rigorous assessment, reflecting an interest analysis approach to analyzing very complex issues. We all owe a debt of appreciation to Professor Malawer for his early and persistent examination of trade policies under the Trump administration. His discussion of challenges confronting the Biden administration is reasonable and pragmatic.”

…………………………………………………………………………………………………………………..

Prof. Stuart S. Malawer. J.D., Ph.D. INTRODUCTION to TRUMP & TRADE (HeinOnline) (2020).

Donald Trump and I are both from Queens, New York. In fact, we are about the same age and were almost neighbors, living less than two miles apart. I have followed his family and his business career since the 1960s. I watched the U.S. Department of Justice charge him in the 1970s for racial profiling in his family’s real estate rentals and observed his opposition in the 1980s to Japanese investment because it competed with his activities in the New York City real estate market. From the earliest days, Donald Trump abused the domestic legal system and lambasted international trade and foreign investment.

On his first day in office, Trump withdrew from the Trans-Pacific Partnership. He has continued to oppose global trade and cooperation with a growing intensity throughout his four years in office. Simply put, he has shown nothing but contempt and blame for trade and multilateral cooperation.

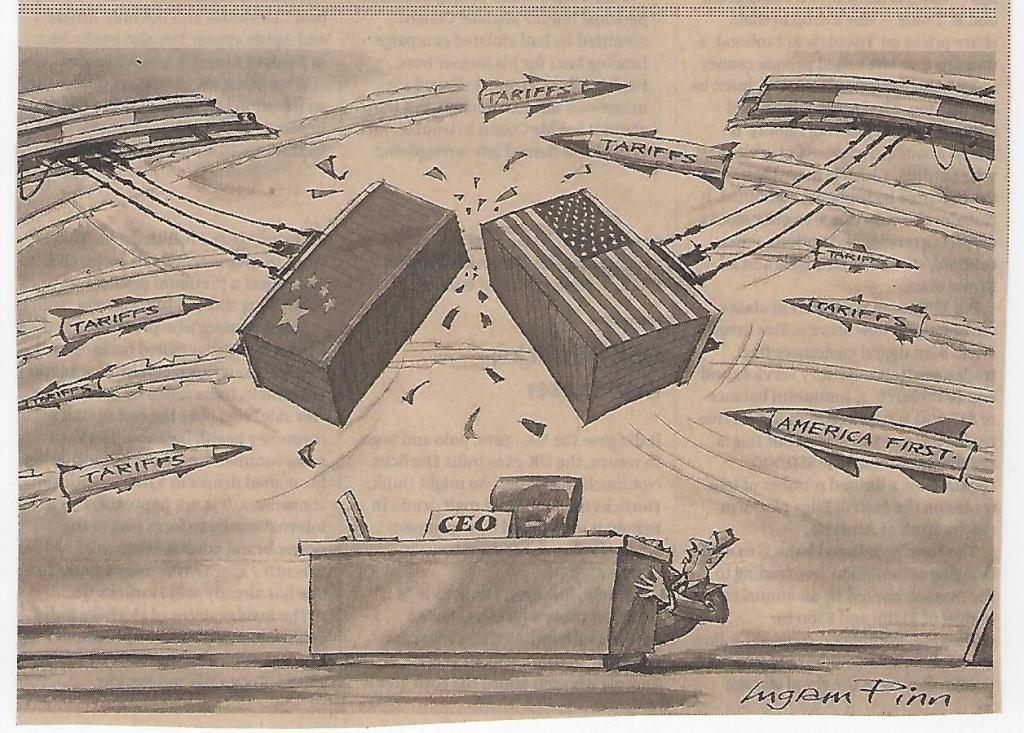

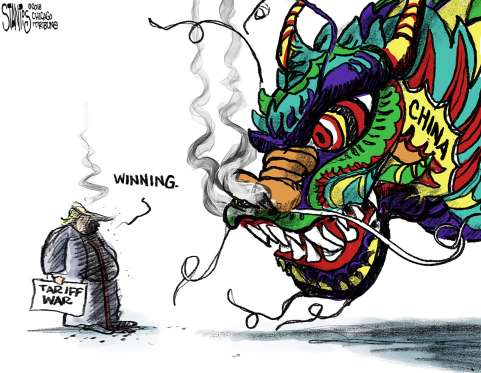

Trump’s continuous attacks on the World Trade Organization (WTO) and his recent withdrawal from the World Health Organization in the midst of the global pandemic are among his most egregious actions. From the outset of his administration, he imposed unilateral tariffs and trade sanctions that are legally questionable under U.S. and international law. He resorted to tariff wars and a broad range of other trade and investment threats against a large number of countries.

His default policy actions are to complain, reject and withdraw. He has complained about NAFTA, NATO, the European Union, the United Nations, the International Criminal Court, the International Court of Justice, and the WTO, among others. He has withdrawn from the Iranian nuclear deal, a bilateral agreement with Iran, UNESCO, the UN Human Rights Council, and the Open Skies Treaty. The Trump administration’s aggressive use and weaponization of treaty termination has never previously occurred. His foreign policy doctrine can very well be labelled “Rejection and Withdrawal.”

These actions or threatened actions concerning trade and treaty relations are consistent with Trump’s “America First” world view, which championed American isolationism in the 1930s. This policy from the ashes of an unfortunate era has only made the United States less safe today. It has placed the United States in opposition to other nations trying to confront global issues collectively.

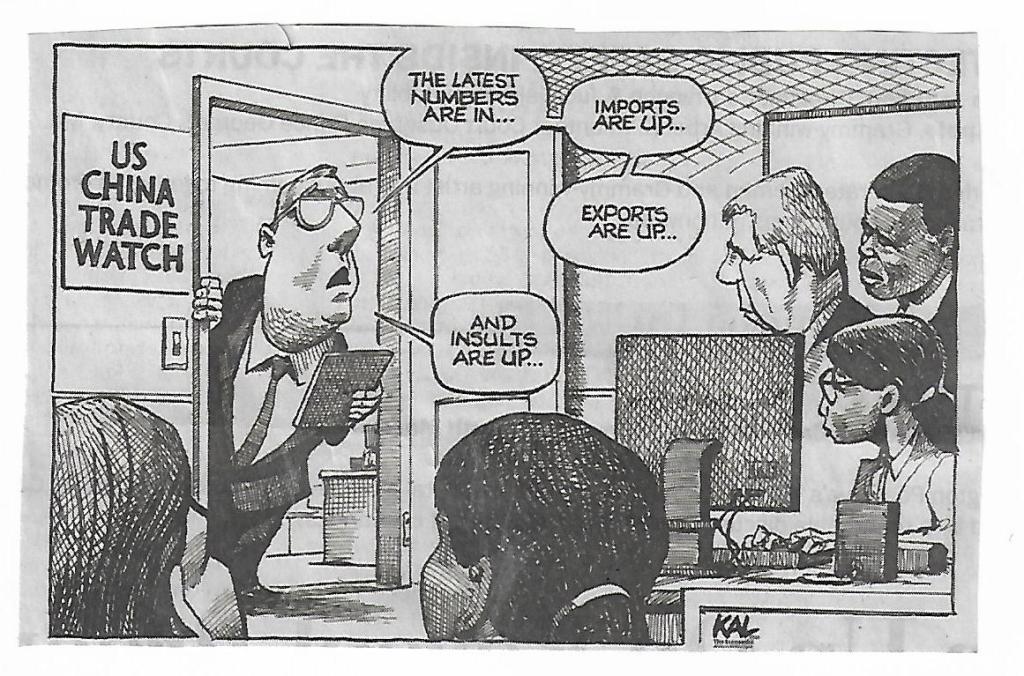

Trump’s foreign policy and trade actions have not led to anything good. They have only hurt the U.S. economy, farmers, and workers. For example, his agricultural tax subsidies to offset export loses to farmers have proven gravely ineffective and his tariffs have not increased manufacturing jobs in the United States. Exports have been dramatically reduced. His use of export and investment controls have significantly hurt technology and telecommunication firms. Global supply chains remain global and reshoring is not happening. His unending and ever-growing animosity toward China, supercharged by his claims relating to the origins of the global pandemic, has now become his principal 2020 reelection strategy. This continues in light of the racial unrest within the United States, which the president further heightened by his astounding militarized response.

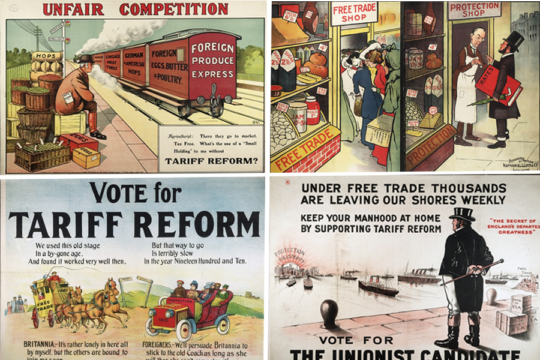

This book is a compilation of my writings as an observer of Trump’s trade policies over the last four years (and a few earlier ones). These have appeared in various academic journals and on my blog “Global Trade Relations.” In particular, I focus on the legal aspects of Trump’s protectionist policies, which hearken back to the 1930s but in many ways are much worse than those policies. Donald Trump clings to the delusion that bilateral pressure will rebalance trade in favor of American industry. Trump’s trade actions raise the issues of constitutional law and the interrelationship of public international law and U.S. constitutional law as matters of paramount concern today. The Trump administration’s actions have also given rise to a new aggressive and proactive federalism to counteract erratic, incoherent, and failed policies (e.g., trade, immigration, climate control, and the COVID-19 pandemic).

If you think about it, the world of the 1930s was much less economically or politically interconnected. If the earlier protectionist, mercantilist and unilateral policies led to global economic chaos and then war, what can today’s actions lead to in a time of nuclear weapons and billions more people involved in global commerce?

Trump’s policies represent an aggressive attack on the post-World War II international order. Most notably, Trump’s attack on the judicial system of the WTO, as a derogation of U.S. sovereignty, is hugely baffling. The WTO’s dispute resolution system was an American initiative that reflected the core American belief in a rules-based global system and the American value of relying upon litigation to provide fair judicial determination of conflicts. Trump’s policies reflect his reliance on unilateral actions, raw power politics, the law of the jungle, bluster, and threats. This has only led to needless stress on the U.S. and global economies.

Trump’s attacks on the existing international system have significantly diminished the standing of the United States in diplomatic relations with our friends and allies and has only emboldened others to take unilateral actions. Consequently, over the last four years, the United States has failed to formulate viable foreign policies and strategies to tackle the multitude of global problems confronting its national interests and security.

In the run up to the fall 2020 presidential election, I offer this book as a primer on Trump’s trade policies and his ferocious and unending attacks on both the U.S. legal system and the rules-based international system and its institutions.

………………………………………………………….

My Blog …. July 23, 2024. “Trump and Toxic Trade Debate.”

The trade debate in the U.S. is now entering a new stage with the apparent nomination of Kamala Harris and J.D. Vance. So far, the trade debate in the U.S. has been particularly toxic, even though there were significant similarities between Biden and Trump. Vance is fervently a protectionist (as is Trump) and Harris and her yet named running mate — well, we don’t know. The public has become very skeptical of trade and its impact on the U.S. economy. The issue of economic warfare, trade sanctions, tariffs, export controls are now being raised again. Sanctions and tariffs are just not very effective and often cause more problems. But new data and candidates can change the terms of the debate and the formulation of newer and more beneficial trade policies, hopefully.

“Donald Trump’s economic panacea is to impose over-the-top tariffs on all imports …. If enacted, it would return our postmodern economy to that of the Gilded Age of the late 19th century, to economic policies favoring the wealthy over the poor and middle class, when tariffs were the main source of government revenue. That tariff-dominant era ended with the 16th Amendment to the U.S. Constitution in 1913, which facilitated the adoption of a graduated federal income tax. The income tax, not tariffs, has been the main source of federal revenue ever since, and for good reason. Tariffs are a tax on imports, the functional equivalent of a sales tax, imposing a proportionately bigger burden on those with modest incomes …. Following the Revolutionary War, the national government did indeed rely almost entirely on tariffs, as pushed by Treasury Secretary Alexander Hamilton to avoid distasteful excise taxes and encourage the new nation’s infant manufacturing sector. The Civil War quickly proved their inadequacy. To meet the resulting fiscal crisis, Abraham Lincoln persuaded Congress to pass the very first income tax in 1862, essentially a tax on only the very top earners …. That was phased out after the war, returning the United States to its reliance on tariffs and the chaos and class resentment they created …. The Democrats’ defeat after the war brought traditional Republicans with their high-tariffs philosophy back into power and they raised tariffs throughout the 1920s. That culminated in the infamous Smoot-Hawley Tariff Act of 1930, which was enacted in the misplaced belief that tariffs could protect American industries and farmers after the 1929 stock market crash. Instead, they fueled a catastrophic global trade war, strangled commerce, unleashed competitive currency devaluations and intensified a worldwide depression that contributed to the rise of Nazism and worldwide war …. The advent of President Franklin Roosevelt, a free-trader and Cordell Hull went on to become an eloquent postwar champion of international trade to save the world from another global crisis …. American politics have a way of flipping the policies of parties. In the modern era, beginning with President Ronald Reagan, it was Republicans who led the way to lower trade barriers as a boon to economic growth…. Trump is the first major Republican of the modern era to enact sweeping higher tariff barriers to protect American industries and farmers …. For his potential second term, Mr. Trump and his running mate, Senator JD Vance of Ohio, would bring the country back to its protectionist past at a time when large segments of the economy depend on trade and foreign investment, not to mention immigration for high-end tech jobs and low-end jobs in services and agriculture …. A case can be made for selective tariffs to protect national security and sensitive supply chains and encourage green technologies. The Biden administration has pushed for these steps while keeping Trump’s tariffs largely in place, incurring many of the same costs. The long historical record demonstrates these are borne not by other countries, as Trump keeps insisting, but by American consumers and industries.” “Trump and Tariffs.” New York Times (July 28, 2024).

………………………………………………

Good recent review of Trump Trade Policy 1.0 ……………….

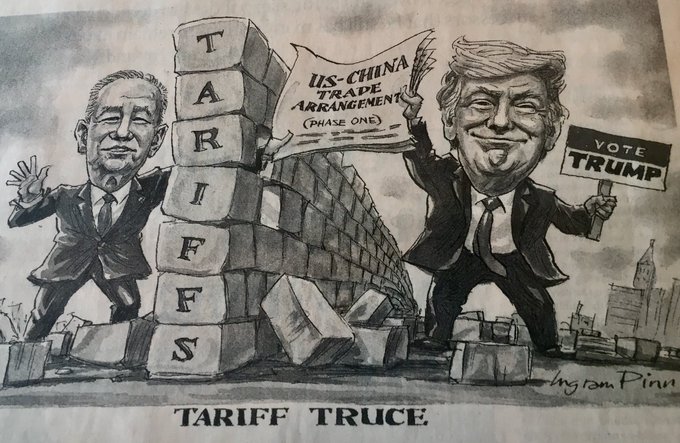

“President Trump’s first term in office was guided by trade. Many changes he and his team made, primarily using trade as a weapon in US foreign and strategic policies, remain in place even after he left the White House, and are now “hardwired” into Washington policymaking …. Trump represented a radical break with past US trade policy practices, but tapped deeply enough into prevailing domestic sentiment that many of his policies were continued under President Joe Biden and look set to continue regardless of who comes next into the White House …. From Trump’s first full day in office in January 2017, when he unilaterally withdrew the United States from the Trans-Pacific Partnership (TPP) agreement, US trade policy was largely driven from the Oval Office without much pushback from Congress …. He was able to resurrect domestic tools such as Section 301 on unfair trade practices or Section 232 on national security …. Again, many of these specific tools have continued in use by the Biden administration. Section 232 tariffs imposed on steel and aluminum are still in place, as are Section 301 tariffs against Chinese products. Biden announced new a Section 232 application for steel by proclamation on July 20, 2024. Section 301 tariffs have also been imposed on a new set of Chinese products in August 2024 …. An important third area of Trump’s original trade agenda was a significant reassessment of the purpose of trade policy. Tools like Section 301 or 232 were harnessed to achieve objectives stemming from a belief that the United States was engaged in an economic war, particularly with China …. Many of Trump’s actions were seen as radical departures from past US practices. His campaign slogan “Make America Great Again” was perhaps best expressed in his trade policy agenda, which put US national and security interests front and center, and weaponized access to the US domestic economy as a tool to achieve a range of broader goals. Although many had expected Biden to return to a more “normal” policy of working in concert with foreign countries in multilateral settings, Biden was content to leave a more muscular and unilateral set of trade policies in place, even expanding them in some cases. Trump’s unusual trade compass reset US trade policy and has already been more durable than anticipated.” “Trump’s Trade Policy.” Hinrich (August 2024).

Good review of Trump’s Trade 2.0 trade proposals …………….

“Trump doubled down on his commitment to new tariffs, pledging to implement “10 to 20 percent tariffs on countries that have been ripping us off for years” …. On the face of it, Trump is proposing a radical overhaul of U.S. tariff policy, going far beyond what he did during his first four years in the White House …. Starting in 2018, Trump imposed tariffs on about $380 billion of goods, mostly from China, according to the Tax Foundation …. The Biden administration kept most of those tariffs and added additional levies on roughly $18 billion of Chinese imports …. In the current election, however, Democrats haven’t indicated support for additional tariffs. …. Trump has suggested the tariffs could be set at 10%, with revenue being used to reduce the deficit or pay for new tax cuts …. Trump has indicated he would support tariffs of at least 60% on Chinese imports to reduce trade with the world’s second-largest economy …. Currently, the average effective tariff is around 1% on imports from countries excluding China and 11% on Chinese imports …. From a practical perspective, it is easy for a president to raise tariffs …. He or she can unilaterally raise tariffs on specific imports for a range of reasons, including if a country violates U.S. trade laws …. Many are skeptical that existing law would allow him to implement an across-the-board 10% tariff without the support of Congress. “Trump’s Tariff Proposals.” Wall Street Journal (Aug. 18, 2024).

Vance just mirrors Trump on tariffs ……………………

Sen. J.D. Vance defended Trump’s tariff policy, saying it penalizes importers who undercut American workers, including with “slave labor,” not consumers …. Mr. Vance defended the tariffs, saying “what it really does is it penalizes importers from bringing goods outside the country, into the country.” “Vance and Tariffs.” Wash. Times (August 26, 2024).

You must be logged in to post a comment.