.

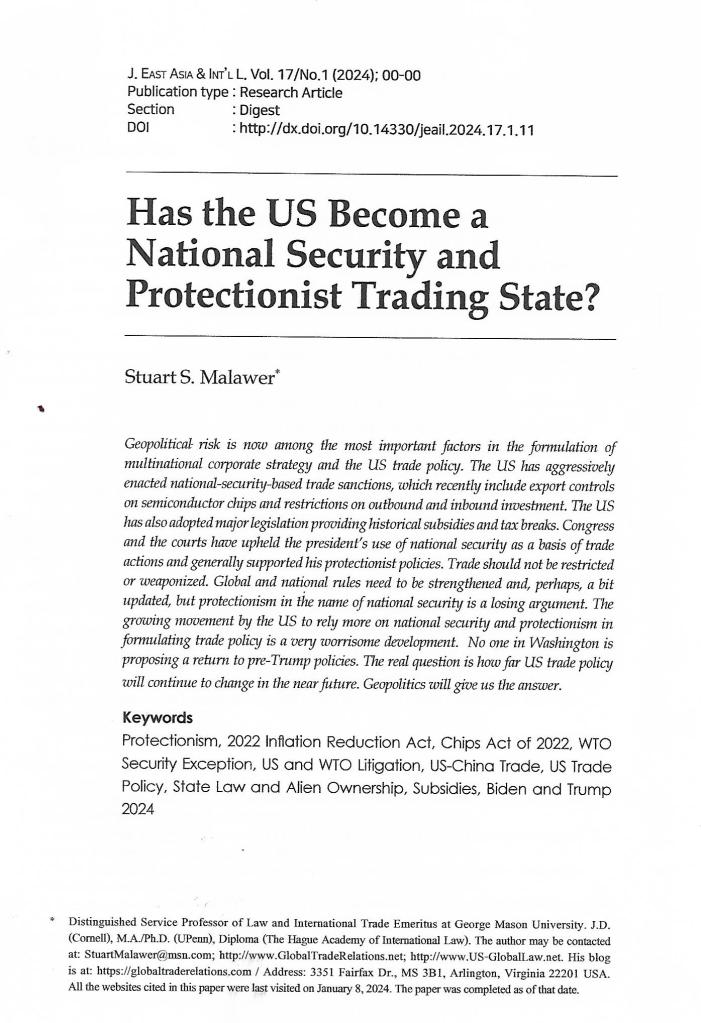

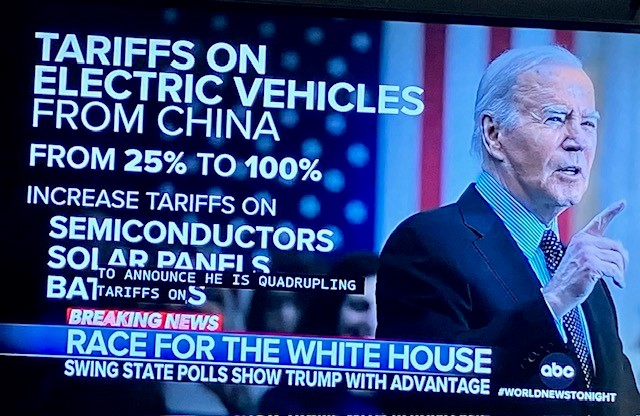

Trade wars and tariffs have become central to U.S. foreign and trade policies under both Trump and Biden— And even more central to this current campaign season. It’s really important to look closely at what has happened over the last eight years and what is currently transpiring during this campaign season. There are differences between Biden and Trump and there are some basic economic factors that are in play, even if both fail to adequately note them.

“There are different kinds of tariff strategies …. Trump used tariffs as a blunt tool in a single-prong strategy to reduce the US trade deficit with China, but for Biden they are part of a much broader plan. This aims not only to tackle Chinese mercantilism, the global economic and political fallout from it and the failure of the existing trade system to address it, but also to expand capacity in key areas like semiconductors and clean tech.” “Not all U.S. Tariffs are Equal.” Financial Times (May 20, 2024).

“A small increase in prices on goods subject to tariffs suggests that retailers absorbed much of the cost. Absorption by retailers and wholesalers would mean that the tariffs function as a tax on businesses … Even if businesses end up absorbing some or most of the tariff, economists still see that imposing a cost. Firms faced with higher prices might have to lay off workers or hold off on expansions. That could sap overall growth and ultimately still affect consumers …. The primary effect is a regressive tax on consumers.” “Tariffs and Who Pays.” Wall Street Journal (May 20, 2024).

You must be logged in to post a comment.