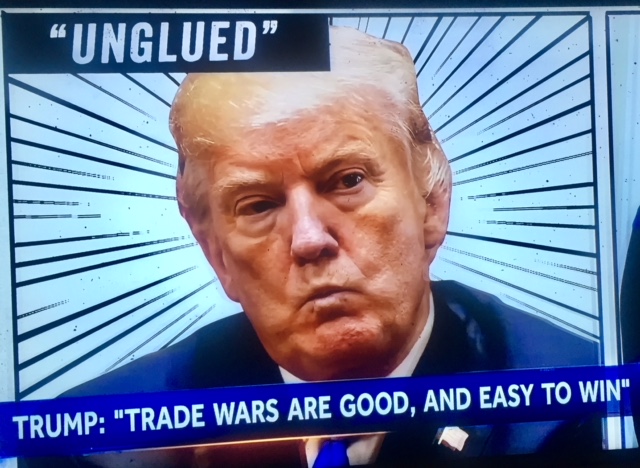

Trump is now relying on obscure or little used legislation as a basis for this tariff actions and threats. These will undoubtedly result in domestic and international litigation. Most likely making new domestic law addressing the Congress’ exclusive authority to regulate trade and impose tariffs. Trump’s actions will also result in more international litigation (WTO & USMCA).

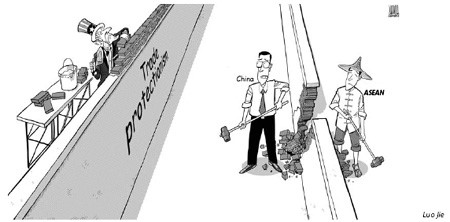

His most recent tariff actions against China, Mexico and China (and threatening the EU) are kicking off a totally unnecessary trade war — with no real economic or trade objective. Primarily motivated by domestic political concerns to rile up his base — no real national security or trade reasons. Grievances and threats are simply no way to conduct sensitive foreign policy. We don’t need a return to the power politics of the 1930’s.

“In an extraordinary act of unity, 1,028 American professional economists in the spring of 1930 signed a letter urging Congress to reject and President Herbert Hoover to veto the Smoot-Hawley Tariff Act. Yet that June, Congress passed it and the president signed it into law. The Smoot-Hawley Tariff helped turn a stock market rout and a building financial crisis into a worldwide depression and triggered a global trade war that halved American exports and imports …. In sum, tariffs don’t have a predictable effect of reducing trade deficits, and trade deficits aren’t necessarily an adverse economic development. Indeed, trade deficits often arise as foreign investors choose the U.S. as a preferred destination for their capital.” “Economists to Trump.” Wall Street Journal (January 31, 2025).

“President Trump will fire his first tariff salvo against those notorious American adversaries . . . Mexico and Canada. They’ll get hit with a 25% border tax, while China, a real adversary, will endure 10%. This reminds us of the old Bernard Lewis joke that it’s risky to be America’s enemy but it can be fatal to be its friend …. Take the U.S. auto industry, which is really a North American industry because supply chains in the three countries are highly integrated. In 2024 Canada supplied almost 13% of U.S. imports of auto parts and Mexico nearly 42%. Industry experts say a vehicle made on the continent goes back and forth across borders a half dozen times or more, as companies source components and add value in the most cost-effective ways …. Tariffs will also cause mayhem in the cross-border trade in farm goods …. Then there’s the prospect of retaliation, which Canada and Mexico have shown they know how to do for maximum political impact. “Dumbest Trade War in History.” Wall Street Journal (Feb. 1, 2025).

“Trump has said he will hit the EU with tariffs, adding the bloc to a list of targets including Canada and Mexico and bringing the US to the brink of new trade wars with its biggest trading partners …. Hitting the US’s biggest trading partners with steep tariffs sharply raises the risks of igniting full-blown trade wars just days into Trump’s second term as president. Both Canada and Mexico have prepared packages of retaliatory tariffs and are ready to implement them. The EU has also said it would defend itself with retaliatory tariffs, as it did in Trump’s first term. “Trumps New Tariffs and Trade War.“ Financial Times (February 1, 2025).

“Trump is now wielding tariffs to achieve a broader set of goals than during his first term, when he focused largely on reducing the trade deficit and countering what he described as unfair Chinese trade practices …. Businesses that vigorously fought tariff proposals during Trump’s first term have largely accepted the fact that more are coming. Their hope now is less to persuade the president to abandon his plans than to be smart about implementing them …. Compared with 2018, the global landscape today reflects greater concern over fragile supply chains, geopolitical tensions and structural factors like aging populations and high levels of public debt – all of which could contribute to higher inflation.” “New Trade War.” New York Times (January 26, 2025).

“Strikingly, Trump reached for an obscure, 90-year-old provision in the US tax code to threaten a doubling of tax rates for foreign nationals and companies if their home countries were deemed to have imposed “discriminatory” taxes on American multinationals. …. Yet, outside the US, the threat of a widening array of trade barriers and conflicts over tax policies is weighing on the economic outlook …. “The New Economic War.” Financial Times (January 25, 2025).

“Trump has long wielded tariffs as a weapon to resolve trade concerns. But the president is now frequently using them to make gains on issues that have little to do with trade …. Trump is also not limiting himself to the trade-related laws he relied on to impose tariffs in his first term …. Trump has appeared willing to deploy a legal statute — the International Emergency Economic Powers Act of 1977, or IEEPA — that gives presidents broad powers to impose trade and sanctions measures if they declare a national emergency …. The W.T.O. carves out exceptions for its members to act on issues of national security, and governments have used that exception more liberally in recent years when imposing tariffs or limiting certain kinds of trade.” “Trump Tariffs for any Cause.” New York Times (Jan. 29, 2025).

You must be logged in to post a comment.