Ceremony at Geoge Mason University celebrating my 46 years of teaching at GMU. Please click here for the video (2021).

US-China trade is one of the most toxic issues today. It raises legal, political, economic and national security issues. The following is a reprint of the recent editorial in the New York Times (Sept. 24, 2023) on the necessity of improving US – China Trade relations. Really outstanding.

The U.S. Is Pulling Back From China. How Far Is Too Far?

New York Times (Sept. 23, 2023)

Many Americans, even once-ardent proponents of globalization, have soured on trade with China. But there is a growing danger that as the United States tries to address its difficulties with China, it will pull back too far, severing economic ties that benefit American families and contribute to global peace and prosperity.

The relationship problems are real, and cannot be minimized. Chinese industrial subsidies, often maintained despite promises to the contrary, stripped millions of jobs from America’s industrial heartland. Chinese companies flagrantly steal American innovations. China’s increasingly confrontational posture toward the United States and its allies — including the economic support it is providing for Russia’s invasion of Ukraine — have underscored the need for the United States to align trade policy more closely with other aspects of America’s national interest. In an example of the prevailing mood in Washington, Representative Mike Gallagher, the Wisconsin Republican who serves as the chairman of the pointedly named “Select Committee on Strategic Competition Between the United States and the Chinese Communist Party,” recently called for broad prohibitions on U.S. investment in China, writing in an essay published in The Washington Post that “we are quite literally funding our own potential destruction.”

A new rule book is needed. Too few leaders, however, appear willing to note that Americans also benefit from trade with China, that the two nations are economically intertwined whether they like it or not, and that it is in America’s interest for the rest of the world to prosper. Americans bought almost $40 billion of Chinese toys, games and sports equipment last year. Soybean farmers in the Upper Midwest sold a record $16.4 billion of their beans to China, mostly for pig feed. Intel takes profits from low-end chips it makes and sells in China to fund the high-end chips it sells in America and to its allies. Hundreds of millions of Chinese have come out of poverty thanks to global trade, and have become consumers of U.S. goods and services. Cummins, an engine maker based in Indiana, operates 21 factories in China, and earns a fifth of its profits from its operations there. “Our success in China has led to global success and U.S. job growth,” Jon Mills, a spokesman for the company, recently told the Times reporter Alexandra Stevenson.

Amid the harsh talk, the dollar value of American trade with China — Americans buying Chinese products and the Chinese buying American products — rose to a record in 2022. The goal of American policymakers ought to be safeguarding the vast majority of those trade flows while addressing the problems that have emerged.

The Biden administration’s top priority in its dealings with China is, as it should be, national security. The president has emphasized the need to limit China’s access to advanced technologies with military applications. An executive order recently signed by Mr. Biden that restricts American investment in Chinese firms that work on artificial intelligence, semiconductors and quantum computing is a measured and necessary intervention. The government’s push to provide subsidies for the domestic production of semiconductors is also a sensible policy. The United States needs to secure reliable access to critical materials.

Hawkish politicians from both parties and American companies that stand to gain from protectionist policies, however, are pushing for a broader retreat from trade with China. Donald Trump, whose dim view of trade helped to propel his successful presidential candidacy in 2016, and who is again the front-runner for the Republican presidential nomination in 2024, is promising to “tax China to build up America.” After the Biden administration suspended tariffs on some Chinese solar panels to accelerate America’s conversion to renewable energy, Senate Democrats and Republicans joined in a vote to reimpose the tariffs. “This vote was a simple choice: Do you stand with American manufacturers and American workers, or do you stand with China?” said Senator Sherrod Brown, Democrat of Ohio. Mr. Gallagher’s committee, with bipartisan support, has been investigating whether U.S. financial giants like BlackRock and MSCI invested in blacklisted Chinese firms, a warning shot aimed at Wall Street.

The Biden administration describes its approach to trade limitations as “small yard, high fence,” meaning that it is aiming to restrict China’s access to a small number of advanced technologies. But some strictures on trade, notably the broad tariffs on Chinese imports first introduced by Mr. Trump and maintained by President Biden, already go too far, imposing costs on American households without much benefit to them or national security.

Keeping the yard from getting bigger is also likely to prove difficult. During Commerce Secretary Gina Raimondo’s recent visit to China, the country’s leading mobile phone manufacturer, Huawei, provocatively released a new smartphone powered by an advanced chip made in China most likely using American technology and machinery. A group of House Republicans sent a letter to the Biden administration citing the phone’s release as evidence of the need for tighter restrictions on China’s access to advanced chips. But China’s ability to make serviceable smartphones does not threaten America’s national security. Restraint is the best policy here. The United States has a legitimate interest in limiting China’s access to military technology, not in preventing the Chinese from checking email.

And while high walls are sometimes essential, so too are broad bridges. It is important to create real penalties for bad behavior by China, but it is also important to reward good behavior. Just as in the United States, there is a debate inside China between trade hard-liners and reformers. America has natural allies among those in China who understand that Beijing has to change and can succeed by playing by the rules.

Defending trade is politically fraught in part because so many American leaders underestimated the impact of China’s rise on American workers and failed to ensure that the benefits were broadly shared.

That failure has changed Americans’ views of how our country relates to the rest of the world. A recent study reports that younger Americans are more skeptical than previous generations that trade is mutually beneficial for participating nations, part of a broader turn toward zero-sum thinking — the belief that gains for one group tend to come at someone else’s expense. The authors argue that the outlook of older generations was shaped by an era of higher growth, in which it seemed plausible that everyone’s boat would rise. Younger generations, by contrast, have been embittered, and policymakers can rebuild support for trade only by addressing those past failures.

The United States can do that by pursuing economic relationships with the world that include protections for the environment and for workers. Other nations will continue to provide industrial subsidies, and the United States can use similar policies to develop new industries, like the renewable energy sector. “We’re retaking control of our energy security and our energy future,” Ali Zaidi, Mr. Biden’s climate adviser, said in an interview with The Times’s editorial board. At the same time, America should continue to pursue deeper economic ties with allied nations, as in a recent agreement to allow electric vehicle batteries made with minerals from Japan to qualify for U.S. tax credits.

American engagement with China is complicated by China’s contradictions. The country remains eager for access to advanced technologies and global markets, but resists giving reciprocal access to its own markets. In recent months, even as China has ended pandemic restrictions and made a show of reopening its doors, it has made life difficult for foreign firms, with raids on corporate offices, for instance. Some measures, like the refusal of Chinese antitrust authorities to let the American chip maker Intel buy the Israeli chip maker Tower, appear to be responses to U.S. restrictions. But longstanding grievances remain unresolved. It has been 22 years since China promised to let Visa and Mastercard operate on equal terms, and 11 years since the W.T.O. ruled that China wasn’t keeping that promise, yet the companies still are struggling for access.

The best reason for optimism is that the two nations still depend on each other. China’s recent struggles — slowing growth, an imploding housing sector, high youth unemployment and capital flight — appear to be motivating a more open stance among Chinese policymakers. And after a period of escalating tensions, the Biden administration also has sought to calm the waters by sending a series of senior officials to the country. In recent years, Chinese airlines have largely refrained from placing new orders for Boeing airplanes, making a political point of buying jets from Airbus, its European rival. But Guillaume Faury, the Airbus chief executive, predicted in a recent interview that the trend would not continue. “I don’t believe that China can rely on one aircraft manufacturer,” he said. “They need competition.” The first narrow-body jets produced by a Chinese company, Comac, entered commercial service earlier this year. The engines were manufactured in Durham, N.C.

The steadily rising trade between the United States and China from 1979 to the present has disrupted the lives of many Americans and caused real harm to some. That said, in the sweep of history those four decades were an era of remarkable peace between, and prosperity for, the two countries.

Some U.S. politicians want to take advantage of China’s dependence to constrain its economic development by denying China the technologies that it needs. The better course is to focus on limiting the reach of China’s military, not its economy as a whole. China sees that it cannot isolate itself from the world; this is not the time for the United States to do so, either.

Editorial Board THE DANGER OF PULLING TOO FAR BACK FROM CHINA New York Times (Sept. 24, 2023)

The following is the introduction from my new article, “US–China Trade Relations: Tectonic Changes and Political Risk in the Global System – National Security, Industrial Policy, and Protectionism.” (Sept. 2023)

The following are excerpts from a recent report on foreign ownership of farmland in Virginia. So my question is — Is this really a problem? When only about 1% is owned by foreign companies. And the leading companies are from Canada, France, Germany and the U.K.

I should point put Chinese ownership is less than 1/2 of 1%. And this is old.

Just completed 14 years of service to the Commonwealth of Virginia as a board member of the Virginia Economic Development Partnership and then as a member of the Virginia Advisory Committee on International Trade (VEDP). Below is an announcement of my first appointment in 2009 by Governor Kaine. Was sworn in by my former George Mason University law student, Judge Joanathan Thatcher of the Fairfax Circuit Court. Of course, with me are my two kids (now lawyers with the U.S. Justice Dept. and the U.S. Dept. of Education) and my wife.

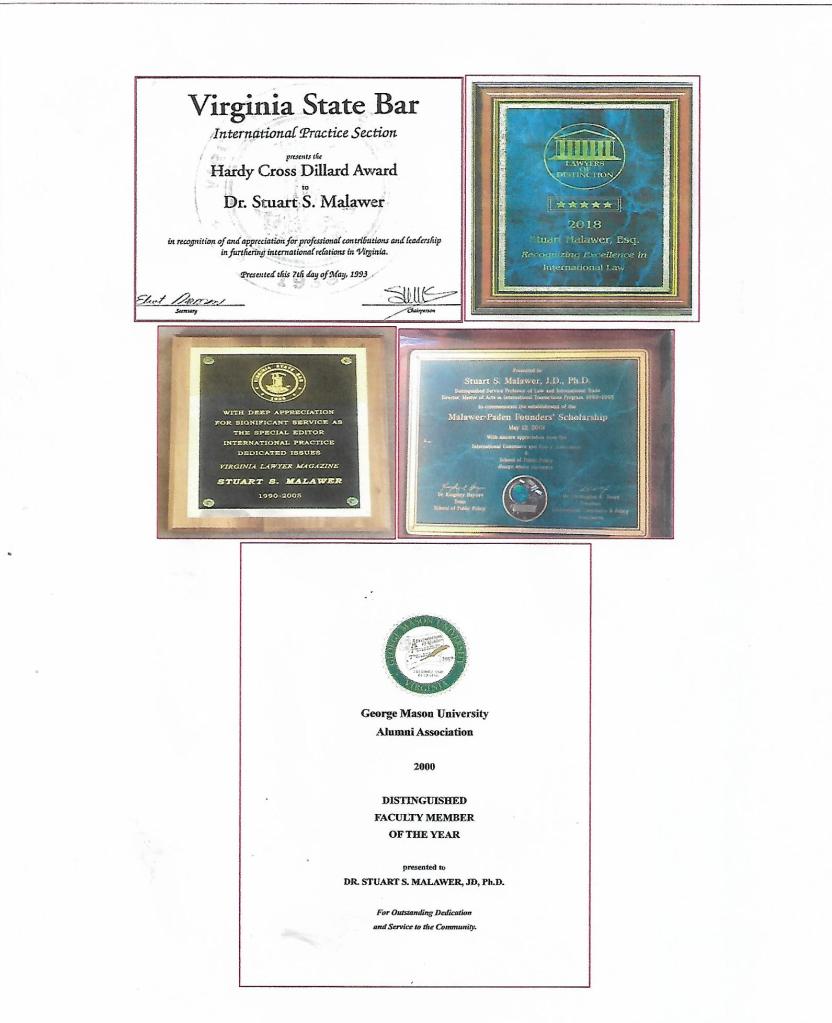

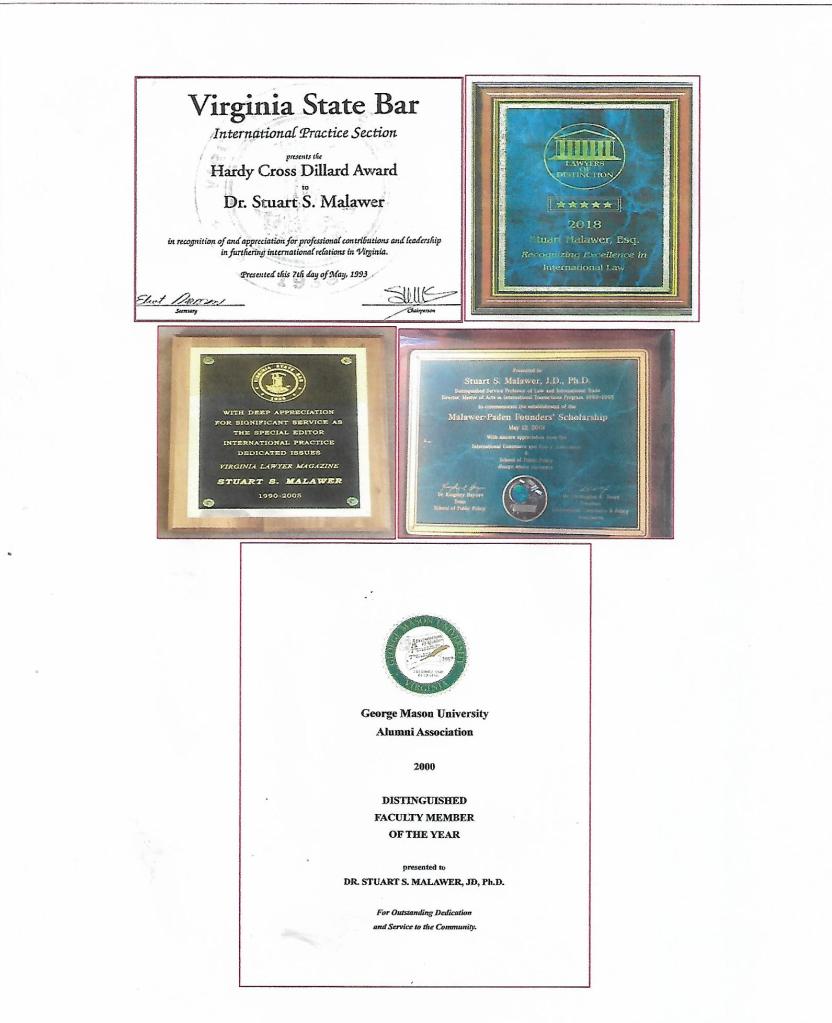

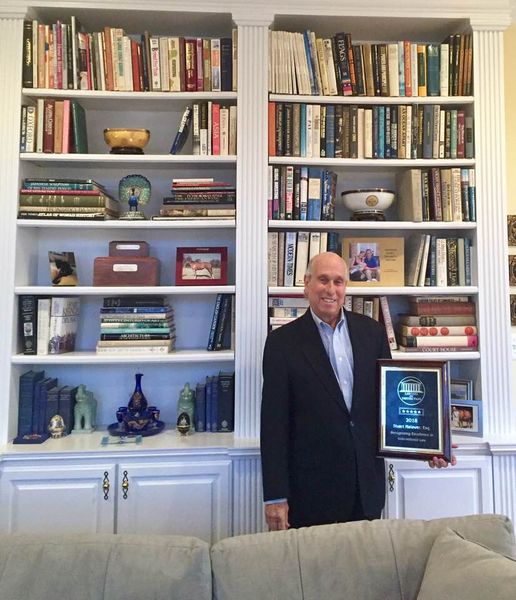

Author Profile – Dr. Stuart S. Malawer Stuart Malawer holds a Ph.D. from the Dept. of International Relations at the University of Pennsylvania. He has a J.D. from the Cornell Law School and a Diploma from The Hague Academy of International Law (Research Centre). He also studied at the Harvard Law School and St. Peter’s College at Oxford University. Professor Malawer was a member of the Virginia Governor’s trade missions to China, India, and Japan. Dr. Malawer was awarded the Hardy Cross Dillard Award by the Virginia State Bar, in recognition of serving as Chairman of its International Practice Section and Special Editor of the Virginia Lawyer. Most recently, he published articles on the US-China trade litigation, Trump’s trade policies, and cybersecurity. Recent books have included Trump and Trade – Policy and Law (2021), Global Trade and International Law (2012), US National Security Law (2009), and WTO Law, Litigation and Policy (2007). Professor Malawer served as the Director and Founder of the Graduate International Transactions Program at George Mason University (a masters’ program in international affairs). He was subsequently named the Distinguished Service Professor of Law & International Trade, as well as the Director of the Oxford Trade Program. This program was held annually in partnership with St. Peter’s College at Oxford and Geneva. The GMU Alumni Association named Professor Malawer the Distinguished Faculty Member of the Year. He was a gubernatorial appointee to the Virginia Economic Development Partnership and recently to the Virginia International Trade Committee. He may be contacted at: StuartMalawer@msn.com

With Governor Mark Warner in China.

From my LinkedIn posts (June 2023) …………….

1 more day and it will be official ….. Retirement from GMU on June 1st after 46 years of teaching at the law school and public policy (and a total of 55 years at other schools). Thanks to many of you for your help with my classes over the years and for the friendship of many others. I am looking forward to continuing our friendship …… Stuart

I want to thank everyone who responded to my post retiring from George Mason University after a total of 55 years of teaching at GMU and elsewhere. Never, ever thought about retirement. Always focused on preparing for the next class and writing the next article. I’m simply amazed about how diverse my students have been and what they are doing now. But what I want to say — It is I who have benefited gigantically, grew and greatly expanded my understanding of the world through your eyes. Thank you !

2018

St. Peter’s College, Oxford (Oxford Trade Program) (1998)

Great article in today’s Washington Post about the new toxic global trade environment concerning political risks — involving national security, balance of power, domestic policies. Here are a few quotes.

“Global Investors and Mounting Political Risks.” Washington Post (April 7, 2023).

You must be logged in to post a comment.