The Biden administration’s trade policy and Trump 1.0 (and now Trump 2.0) focused on redoing U.S. trade policy and developing a newer industrial policy promoting U.S. industry, workers and national security. (So they say …) Clearly, trade policy and in particular tariff policy have undergone and continue to undergo significant rethinking by many in the U.S. Biden’s reassessment was significant.

This was built upon Trump’s earlier attack on the existing trade policies. The promise of Trump 2.0 seems to be even exponentially greater than both Trump 1.0 and Biden’s policies, especially as to China. Here’s a recent statement of the outgoing Biden’s USTR (Kathrine Tai) on trade policy generally and comments on China and the intertwining of new global tariff threats and new global tax rules. China has instituted new laws concerning retaliation and national security and the U.S. has recently opened a Section 301 investigation into Chinese maritime industry practices.

“The effects of trickle-down policies have become all too clear. They have left working people behind all over the world, pitting those in one economy against those in another as the private sector prioritizes short-term profit …. Laissez-faire globalization has left the United States and other democracies vulnerable and less secure …. China, in particular, is actively intervening in the marketplace to dominate key sectors and to strengthen its ability to coerce others to leverage more favorable political and economic decisions …. Trade policy must work hand in hand with domestic economic policy, not be placed in a separate silo …. Executing a fair competition agenda after decades of laissez-faire policies is not a simple task …. The world is moving past the paradigms of the Chicago school and the so-called Washington consensus, and that gives the United States the chance to shape trade and international economic policy so that it is more equitable for the underserved at home and abroad.” “Purpose of Trade Policy.” Foreign Policy (Jan. 2025).

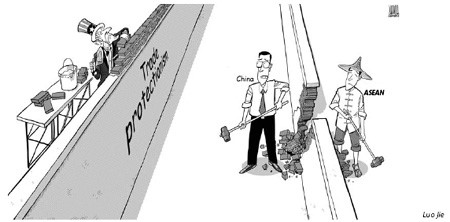

“A long series of tit-for-tat measures and countermeasures risks growing into an all-out trade war, and this would cause substantial damage to the world economy …. Washington’s long quest to punish China — carried from Trump’s first administration into President Joe Biden’s, and now into a second Trump term — rests on some muddled thinking about the challenge Beijing presents. Gripes about trade and fears stemming from lost U.S. manufacturing jobs have gotten mixed up with concerns about the threat that China’s rise could pose to national security …. This moment calls for increased collaboration to protect a global economy that remains tightly intertwined despite years of brewing hostility between its two dominant powers.” “How Not to Deal With China.” Washington Post (Jan. 13, 2025).

“The imposition of tariffs in response to global tax measures could hamper economic growth by raising operational costs for businesses and increasing prices for consumers …. A key part of the OECD deal is known as the undertaxed profits rule and often referred to as the UTPR, is viewed as discriminatory. The rule allows countries to increase taxes on a local subsidiary of a multinational group if the multinational pays less than 15 per cent of corporate tax in any other jurisdiction. The rule would mean other countries would be able to levy top-up taxes on US companies.” “Tariffs and Global Tax War.” Financial Times (January 14, 2025).

“A strategy for a world barraged by Trump’s promised tariffs is to ignore them. Incensed as countries might be about U.S. bullying, leaders abroad should look for paths around America and work to rebuild the global trading system …. Rather than shooting themselves in the foot, countries might instead copy one thing China did when it was hit by tariffs during Trump’s first term: It lowered tariffs on imports from other countries. This disadvantaged American exporters and benefited the Chinese economy by attracting cheaper imports from the rest of the world …. This sort of strategy might even temper Trump’s hand. The United States is a big market, but it accounts for only 13 percent of global imports. Many countries could replace lost access to the United States fairly easily.” “Fighting a Trade War.” Washington Post (January 18, 2-25).

In the past, Beijing’s responses were measured. But its words and actions are growing sharper, and the targets of its retaliatory blows are widening to include supply chain vulnerabilities, critical minerals and individual companies …. Likewise, Beijing’s punitive actions increasingly mirror Washington’s …. China has quietly passed its own laws that ban compliance with laws, sanctions or boycotts in other countries. The commerce ministry has the authority to deem commercial decisions as a threat to China’s national security.” “China and Retaliatory Trade Sanctions.” New York Times (January 19, 2025).

“The new Biden investigation, issued by the US trade representative under Section 301 of the Trade Act, lays out how China has used non-market practices to dominate the global maritime industry …. More importantly, there are legitimate national security and commercial supply chain reasons to build more non-Chinese maritime capacity …. Of course, increasing maritime capacity is a long-term, heavy lift. And yet, the success of the Chips Act, which has rebooted US semiconductor production in less than two and a half years, shows that it is possible to create more resiliency and redundancy in critical industries when there is political will.” “Trumps Challenge on Trade.” Financial Times (January 19, 2025).

You must be logged in to post a comment.