Trump’s announcement of proposed tariffs on Mexico, China and Canada for his first day in office is signaling no uncertain terms his contempt for treaties, international law, the global trading system (to change it) and a return to crony capitalism in U.S. trade and tariff formulation and implementation. Trump will be picking economic and diplomatic fights with friends and foes — for both economic and non-economic reasons. The next four tears are going to be chaotic and not good for either the U.S. or the global trading system and its institutions.

Additional problems relating to trade will undoubtedly emerge, including changes in currency policies of both the U.S. and other countries, leading to currency wars (in addition to tariff wars). Trump’s proposed movement of leadership over tariff issues to the Department of Commerce away from the USTR, contrary to the initial Congressional intent in forming the USTR decades ago, signifies to me a focus on corporate capturing of trade policy — in contrast to accepting a broader national view for US trade policy. In the meantime the Biden administration is still imposing newer export controls on chips to China. Undoubtedly, retaliation (such as restrictions on export of rare earth minerals or sale of US Treasuries) will occur sooner ha later.

“Trump said that he would impose tariffs on all products coming into the United States from Canada, Mexico and China on his first day in office, a move that would scramble global supply chains and impose heavy costs on companies that rely on doing business with some of the world’s largest economies …. Taken together, the tariff threats were a dramatic ultimatum against the three largest trading partners of the United States, and a move that threatens to sow chaos in America’s diplomatic and economic relationships …. Mexico, China and Canada together account for more than a third of the goods and services both imported and exported by the United States …. Imposing tariffs on Canada and Mexico would also violate the terms of the North American trade agreement that Mr. Trump himself signed in 2020, called the United States-Mexico-Canada Agreement.” “Trump and Tariffs in China, Mexico and Canada on First Day.” New York Times (11.26.24).

“The levies (would violate USMCA) could be imposed using executive powers that would override the USMCA, the free trade agreement Trump signed with Canada and Mexico during his first term as president.” “Trump and Tariffs – China, Mexico and Canada.” Financial Times (11.26.24).

“The major question is whether the threats are a negotiating ploy to wring concessions on trade and other policy priorities from U.S. trading partners, or the start of a sustained campaign to reshape global trade and the American economy …. The threatened tariffs on Mexico and Canada are the bigger surprise, and suggest Trump is eager to reopen the U.S.-Mexico-Canada Agreement, a free-trade accord that came into force in 2020. The USMCA replaced the decades-old Nafta pact, which Trump repeatedly described as the “worst trade deal ever made” …. His tariff threats suggest Trump is seeking to include immigration, security and drugs in a negotiation that usually revolves only around trade, as well as accelerate a planned review of the USMCA scheduled for 2026. “Trump Threatens Tariffs.” Wall Street Journal (11.26.24).

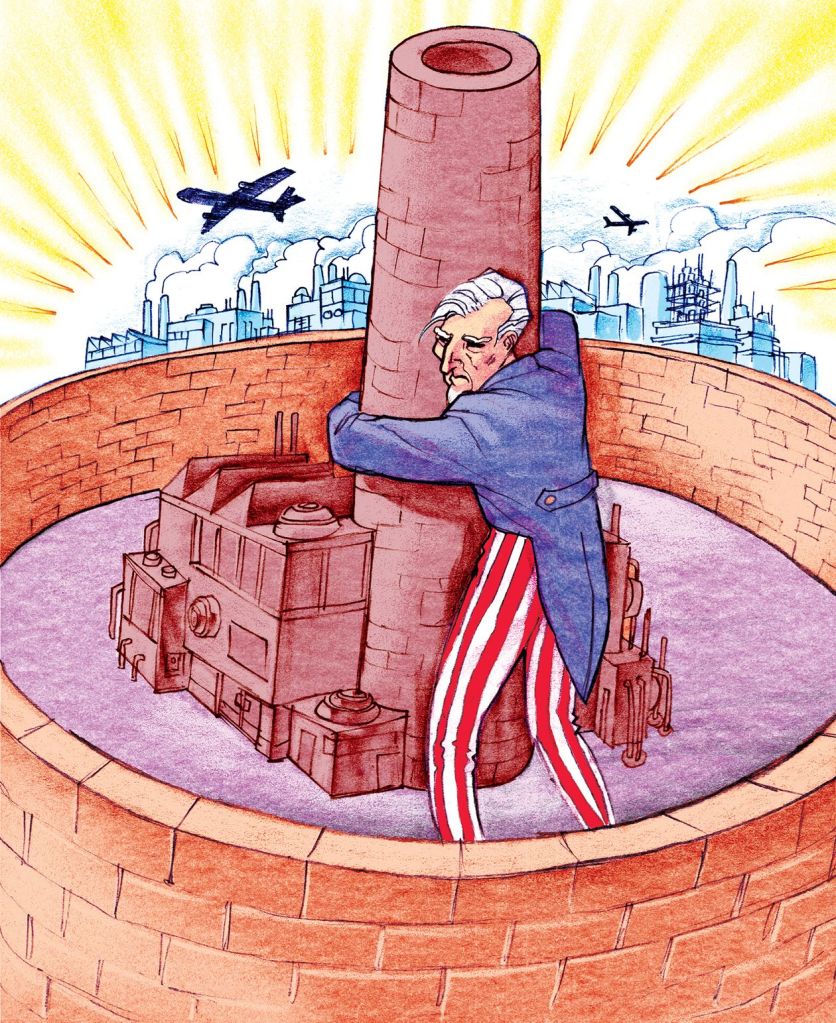

“U.S. trade law gives the executive branch broad discretion in tariff-setting, including the ability to grant exemptions in special cases. So you apply for one of those exemptions. Will your request be granted? …. Trump imposed significant tariffs during his first term, and many businesses applied for exemptions. Who got them? A recently published statistical analysis found that companies with Republican ties, as measured by their 2016 campaign contributions, were significantly more likely (and those with Democratic ties less likely) to have their applications approved …. But that was only a small-scale rehearsal for what could be coming …. The tariff proposals Trump floated during the campaign were far wider in scope and, in the case of China, far higher than anything we saw the first time around; the potential for political favoritism will be an order of magnitude greater…. As I understand it, the term “crony capitalism” …. Time will tell. The evidence suggests that the rules for how to succeed in American business are about to change, and not in a good way.” “Crony Capitalism and Trump Tariffs.” New York Times )11.2524).

“The legitimacy of the international campaign to deter Russian aggression is based on international law, with the ICC case against Putin as a centerpiece …. The emerging clash between the US and its allies over Israel is part of a much broader argument about the future of the world order …. Trump is turning the US into a revisionist state that is challenging every element of the liberal international order it once built: free trade, openness to migration, multilateralism, security alliances, solidarity between democratic nations and the protection of human rights,” “Israel, Western Alliance and International Law.” Financial Times (11.25.24).

“Well, here we go. Trump is still two months from returning to the White House, but he’s already wielding tariffs as an all-purpose bludgeon to achieve his political and foreign-policy goals. Markets will have to get used to it because this is going to be Mr. Trump’s second-term method, no matter the economic and strategic ructions …. This is an extraordinary use of tariffs, but Mr. Trump is going to use this threat often in his second term …. It’s also possible that Mr. Trump views tariffs not merely as a tool for ad hoc negotiation but as a lever to remake the entire global trading system. In that case he’ll try to build high tariff walls in an attempt to force U.S. and foreign companies to build nearly everything in America. The economic and political harm from that strategy is for another day, but investors can’t rule it out and members of Congress would be wise not to give him that power.” “Trump and Tariff Bludgeon.” Wall Street Journal (11.27.24).

“Trump has made it clear that he believes a confrontation with China over trade and technology is inevitable. In the first Trump administration, the Chinese government took mostly symbolic and equivalent measures after U.S. tariffs and trade restrictions. This time, China is poised to escalate its responses …. Since 2019, China has created what it called an “unreliable entity list” to penalize companies that undermine national interests, introduced rules to punish firms that comply with U.S. restrictions on Chinese entities and expanded its export-control laws. The broader reach of these laws enables Beijing to potentially choke global access to critical materials like rare earths and lithium …. The Chinese government will use supply chains as a weapon to advance their interests.” “China Trade Weapons in Response to Trump.” New York Times (Nov. 27, 2024).

“But character is destiny. An administration of narcissists will be a snake pit, in which strife and self-destructive scandal will snuff out effective action. Running things is hard, and changing things is harder, and it’s rarely done well by solipsistic outsiders …. What kind of person do we want our children to become — reformers who honor their commitments to serve and change the institutions they love or performative arsonists who vow to burn it all down?” “The Moral Challenge.” New York Times (11.28.24).

“The Biden administration announced broader restrictions on advanced technology that can be sent to China, in an effort to prevent the country from developing its own advanced chips for military equipment and artificial intelligence …. The rules advance measures the Biden administration issued in October 2022, and again in October 2023. They have been the subject of fierce lobbying by both national security hawks eager to crack down on China and the chip industry …. Shipments of chip-making equipment to China from firms like ASML in the Netherlands and Tokyo Electron in Japan have surged in recent years, as those companies have stepped in to provide China with the technology that U.S. companies cannot.” “New Biden Controls on Chip Exports to China.” New York Times (12.3.24).

“President-elect Donald Trump has introduced a momentous change to international trade relations …. The world trading system survived special deals in the China Phase I agreement in the first Trump administration, and it would survive a special deal with more European purchases from the United States of liquefied natural gas or military equipment …. What should be of more concern is the spread of one-off trade deals as the new normal. A deal acceptable today might not be tomorrow …. Power can be used to build something or to destroy something. In 1971, President Nixon imposed a 10 percent import surcharge. It led ultimately to the reform of the international monetary system and to a major round of multilateral trade negotiations. Power, however, can equally bring chaos, in which case, no economy will benefit.” “Trump Trade – Demands, Not Rules.” PIIE (December 3, 2024).

“Trump said he would impose 100% tariffs on members of the Brics group—whose members include Brazil, Russia, India, China and South Africa—if they create their own currency or seek to replace the U.S. dollar as the main global trade currency …. The pursuit of alternative currencies and methods of settling trade without the dollar risks undermining the U.S.-led international financial plumbing,” “Trump’s Currency Threats (Brics).” Wall Street Journal (December 4, 2024).

“Trump’s threatening retaliation against the unlikely creation of a BRICS currency only reinforces the rest of the world’s concerns about the U.S. willingness to wield dollar dominance as an economic and geopolitical weapon ….. The dollar has been the world’s dominant currency for about a century and has served as the world’s reserve currency since the end of World War II. It makes up the majority of foreign exchange reserves held in global central banks and is widely used in international transactions such as trade and loans.” “Trump’s Currency Threats (Brics).” New York Times (December 5, 2024).

“Trump’s defense of the dollar is a window into how he thinks the U.S. should exercise its economic power. That power, he argues, has been undercut by its excessive use of financial sanctions that encourage other countries to avoid using the dollar …. Tariffs are less likely than sanctions to discourage use of the dollar. They can be calibrated, whereas sanctions are usually all or nothing …. But tariffs have disadvantages. Like sanctions, if overused, they can drive down trade so much the U.S. has no leverage left.” “Trump and Economic Power.” Wall Street Journal (December 5, 2024).

“The Commerce Department has traditionally focused on promoting the interests of American business and increasing U.S. exports abroad. But in recent years, it has taken on a national security role, working to defend the country by restricting exports of America’s most powerful computer chips …. The expanding role of the department is a recognition of how much economics, intelligence and defense have become intertwined …. Ms. Raimondo’s assertion that economic issues are core to national security is increasingly the common wisdom in Washington …. the U.S. government had dramatically increased its use of export controls and related tools in recent years. Trump added three times as many Chinese entities to national security-related lists in his first administration than the total of presidents over the previous 16 years.” “Commerce Dept. and National Security.” New York Times (December 9, 2024).

You must be logged in to post a comment.