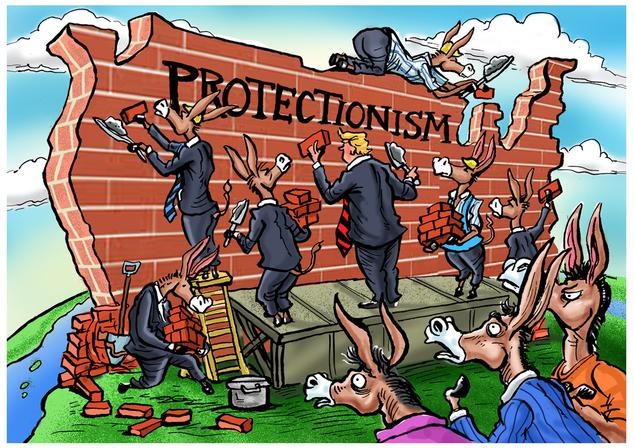

U.S. trade policy continues to rely upon ‘national security’ as a rationale for action. This is really questionable. Often decisions espousing national security reflect nothing more than domestic politics and protectionism. One such case (TikTok) is now before a federal court and the other case (Nippon Steel) is now on hold for more study by CFIUS.

“The Biden administration is granting a request by Japan’s Nippon Steel to resubmit its filing with the Committee on Foreign Investment in the United States for approval to purchase U.S. Steel …. CFIUS will use the additional time to review the deal so that it can better understand the full national security impact of the transaction, along with how it would impact critical supply chains …. The transaction has also become tangled with swing state politics, as U.S. Steel is based in Pennsylvania, which could help to determine the outcome of the November presidential election.” “Steel Deal Time Extended.” New York Times (Sept. 18, 2024).

“TikTok on Monday pushed back against a law that would force the popular video app to sell to a non-Chinese owner or be banned, in what is shaping up to be a landmark case …. A panel of federal judges on Monday made pointed remarks that called TikTok’s legal arguments into question, in a landmark case that could determine whether the Chinese-owned video app survives in the country …. The hearing, before the U.S. Court of Appeals for the District of Columbia Circuit, lasted roughly two hours. Three judges asked probing questions of both TikTok and the government about an April law that forces ByteDance, the app’s owner, to sell TikTok to a non-Chinese company before Jan. 19 or face a ban in the United States …. American lawmakers and intelligence officials have argued that TikTok is a national security threat under ByteDance …. The concerns among lawmakers and intelligence officials are at odds with how the American public views TikTok. Only 32 percent of Americans support a ban of TikTok, down from 50 percent in March 2023, according to a recent survey from the Pew Research Center. “TikTok and Court Skepticism.” New York Times (Sept. 16, 2024).

“What’s truly inexplicable, though, is the likely rationale for the steel ban: national security. Perhaps in the 1980s, Japan could have been considered a strategic economic threat. It was fear of “Japan Inc.” that prompted Congress to authorize presidents to block prospective mergers on national security grounds, after vetting by the body currently reviewing Nippon Steel’s bid: the Committee on Foreign Investment in the United States, or CFIUS …. Along with the hostile signal it would send other geopolitical allies interested in investing in U.S. industry, the lack of any plausible economic reason to block this sale leaves politics as the only explanation.” “Steel Trap (Editorial).” Washington Post (Sept. 12, 2024).

“The government justifies punitive action against Chinese-owned video-sharing app TikTok as crucial to “national security.” Simultaneously, however, the government claims that a Japanese steel corporation’s purchase of U.S. Steel would threaten “national security”: Federal officials feign alarm (this is too risible to be other than political theater) about a corporation from an allied nation …. Government will, as usual, say that its steadily enlarged control of our lives is for our own good. Regarding TikTok, the government says its control is to protect us from influences we cannot be trusted to properly assess. And, of course, to enhance “national security.” “The Tik Tox Case and National Security.” Washinton Post (Sept. 18, 2024).

“White House officials are signaling that President Joe Biden will not imminently move to block Nippon Steel’s bid to acquire U.S. Steel …. The proposed corporate acquisition has assumed outsize importance given its potential political impact on the 2024 election …. But in towns near Pittsburgh, many steelworkers and their neighbors were upset by word of the president’s apparent plan to kill the deal, which they see as the best chance for U.S. Steel’s outdated mills to survive …. If states routinely approved or rejected proposed investments by foreign companies on the basis of domestic political concerns, other countries would do the same to American businesses, said the U.S. Chamber of Commerce and the Global Business Alliance.” “Delaying US Steel Decision.” Washington Post (9.13.24).

You must be logged in to post a comment.