A new hypothesis seems to be emerging concerning China’s trade policies and U.S. law, which I agree with to some extent. That China’s global trade policies are in response, in part, to restrictions and other actions under U.S. trade law. An outstanding article recently appeared in the Financial Times (2.27.24) discussing this correlation between China trade policies and U.S. law. More work needs to be done to fully explore this very interesting law and policy observation. Here are a few excerpts from this lengthy analysis:

- Even during the first blush of the honeymoon period that attended China’s accession to the World Trade Organization in 2001, it was clear that Washington and Beijing were — as a Chinese idiom has it — “sharing a bed but dreaming different dreams”.

- As the world trade body falters, China is accelerating efforts to construct an alternative trade architecture that is insulated from US influence and centered upon the developing world.

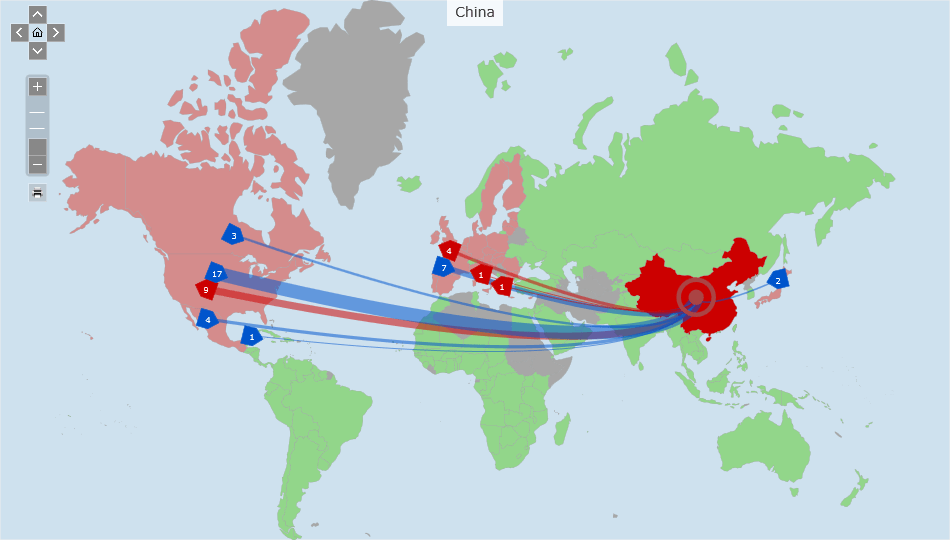

- The architecture under construction revolves around a China-centric network of bilateral and regional “free trade agreements” (FTAs), which allow for trade at low tariffs while also promoting direct investment flows, Chinese officials and trade experts say.

- This alternative is mainly based on the BRI, to which China is progressively trying to shift its exports from traditional markets like the US and EU.”

- The dysfunction of the WTO’s appellate body — the top appeals court for world trade — has meant that many multibillion-dollar trade disputes sit in legal limbo, making commerce more costly and complicated. Most analysts do not foresee drastic scenarios such as the demise of the WTO.

- But it was after the US excluded China from talks to join the Trans-Pacific Partnership, a big multilateral trade deal that was signed in 2016, that Beijing really threw its FTA program into overdrive.

- China does not wish to see the demise of globalisation as represented by the WTO. On the contrary, Beijing has been a clear beneficiary of trade liberalization over more than two decades, enjoying more than a 10-fold increase in its total trade since its 2001 accession to the world trade body, vastly outstripping the global average by several times. But in spite of all the effort that Beijing has expended in building its alternative trade architecture, the current escalation of trade friction with both the US and EU means that China remains gravely exposed to risks that global trade.

- During the administration of Donald Trump, which ended in 2021, the US imposed tariffs on some $300bn in Chinese exports. EU competition commissioner Margrethe Vestager said this month the bloc was “absolutely willing to use” trade tools to tackle unfair Chinese trade practices.

- With so much uncertainty hanging over the future, Chinese companies are taking pre-emptive measures to skirt whatever trade altercations are coming their way.

- Chinese companies are seeking to circumvent US and EU tariffs in a number of different ways. One of these ways is transshipment, a method that is fully on display in Mexico, which as a member of North American Free Trade Agreement (Nafta) can export goods to the US market at much lower tariffs than China can access.

- Another trend is for “nearshoring” — or the relocation of production capacity closer to customers to limit vulnerability to geopolitical tensions — which is reconstituting China’s global footprint. Chinese direct investment flows into Malaysia, Indonesia and other countries seen as useful “nearshoring” countries have been on the rise.

- But even here, Chinese investors are not necessarily safe. “China’s FTAs can facilitate Chinese companies to set up factories and manufacturing plants in foreign countries to eventually export to the US and EU,” says Liu. “But if laws in the US and EU change to include additional restrictions on Chinese ownership of factories outside of China, Chinese factory migration may eventually prove to be not as effective,” she adds.

You must be logged in to post a comment.